Web 3

Global Crypto Taxes 2024: Tips for Global Investors

May 27, 2024

Table of Contents

Key Takeaways

In the rapidly evolving digital asset landscape, the complexities of crypto taxation have become a critical global issue. With changes observed in various countries, governments intensify efforts to combat tax evasion on digital assets, and more crypto-related assets and activities may face taxation. As a result, crypto taxation is poised to become more stringent in the near future. By staying informed about the evolving crypto tax landscape, global investors can better navigate the complexities and maintain compliance.

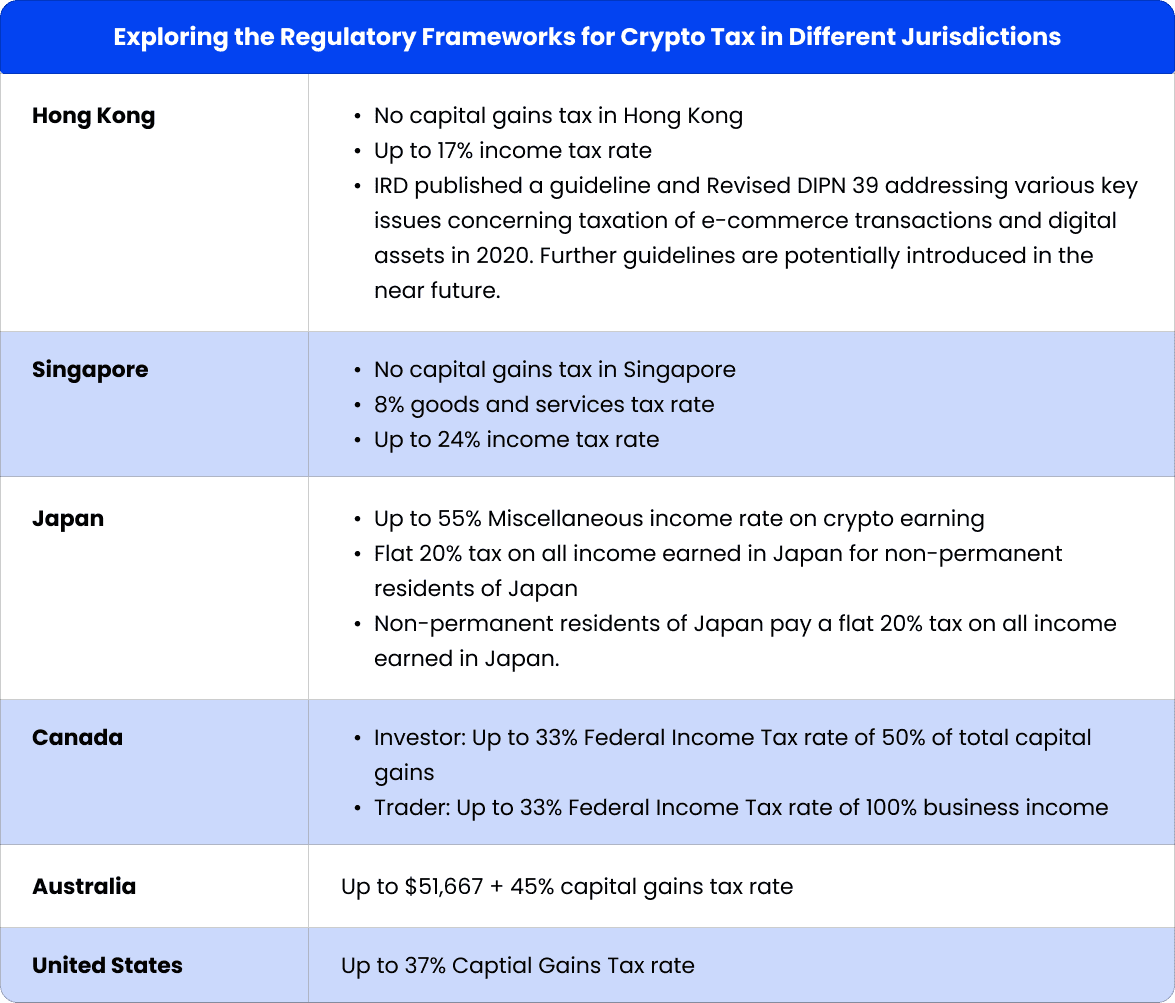

Exploring the Regulatory Frameworks for Crypto Tax in Different Jurisdictions

Towards Crypto Tax Transparency: the Drive for Unified Reporting

Hong Kong continues to be a highly appealing jurisdiction for taxpayers. The city's world-class infrastructure, robust legal system, and favorable tax environment make it an exceptionally attractive destination for businesses and individuals seeking a dynamic, prosperous base of operations. Individuals who engage in crypto activities as investments are spared from capital gains tax, providing a favorable landscape for investors. However, for corporations and crypto professionals whose digital assets are traded as part of regular business operations, income tax becomes a pertinent consideration. While the Inland Revenue Department (IRD) released a revised version of DIPN 39 in 2020, laying the groundwork for crypto taxation principles, it falls short in addressing the latest developments in decentralized finance, staking, and non-fungible tokens (NFTs).

On a global scale, 54 countries have taken a significant step forward by pledging to join the OECD's Crypto Asset Tax Reporting Framework (CARF). The CARF, along with the Common Reporting Standard (CRS) from the OECD, aims to establish reporting obligations for a wide range of crypto assets, including cryptocurrencies, stablecoins, security tokens, crypto derivatives, central bank digital currencies (CBDCs), and other specified e-money products. The goal is to create a more level playing field for tax authorities worldwide.

The development will provide much-needed clarity and certainty for businesses and individuals engaged in crypto-related activities, enabling them to navigate the regulatory landscape more effectively. However, the ultimate success of the unified framework will depend on the ability of tax authorities to collaborate, adapt, and respond to the evolving crypto landscape, which is still currently in progress.

The Worldwide Tension Between Crypto Regulation and Privacy

Australia is taking a proactive approach to crypto tax compliance, requiring exchanges to hand over personal data and transaction details for approximately 1.2 million accounts. The purpose of this requirement is to identify traders who have not reported crypto trades. The ATO recognizes that the complexity of the crypto industry may contribute to a lack of understanding among users regarding their tax obligations and may increase the risk of individuals attempting to evade tax obligations by purchasing cryptocurrencies using false information.

Similarly, the Canada Tax Agency (CTA) has taken action to combat crypto tax evasion by initiating nearly 400 audits. The aim is to recover an estimated $54 million Canadian Dollars (approximately $309 million Hong Kong Dollars) in suspected unpaid taxes. The CTA also emphasizes the importance of enhancing public education on crypto tax obligations to ensure transparency and compliance with taxable crypto transactions.

The policies indicate a clear trend towards tighter regulation of crypto taxation in the near future. However, this may raise concerns regarding the balance between regulation and privacy, as well as the potential uncertainty of tax policies in the crypto space at this stage. As governments seek to bring greater oversight and transparency to the crypto ecosystem, there are questions about how to protect individual privacy and freedom of financial transactions. This is especially pertinent given the decentralized and global nature of cryptocurrencies, which can operate outside traditional financial systems. The rapidly evolving crypto landscape means that tax policies may need to be frequently updated and adjusted, creating potential instability and ambiguity for investors and businesses. There are concerns that overly restrictive or hastily implemented regulations could stifle innovation and undermine the potential benefits of crypto technology.

How UTGL Can Offer Privacy Protection in this Uncertain Regulatory Environment

In a landscape where tax policies surrounding cryptocurrencies are still shrouded in uncertainty, setting up a trust to manage all your digital assets will be more important than ever to protect your privacy. By transferring the legal title of your digital assets to your trustee, your digital assets and identity receive an additional layer of protection under well-established trust law in Hong Kong.

At UTGL, you are able to freely make use of your digital assets through our Asia's First FinTech Trust Platform and our Asset Link Credit Card. Functions including global invoice payments, digital asset transfers, exchanges, and earn and invest ensuring that you can enjoy the flexibility of using your digital assets for your daily living with high data protection and confidentiality.

Our team of experts is dedicated to providing comprehensive guidance, ensuring compliance, and safeguarding your privacy. Whether you have questions, need clarification, or simply want to explore your options, please don't hesitate to contact us. We are here to assist you and address any concerns you may have.

RELATED ARTICLES