TRUST

UTGL Cards vs. Traditional Bank Cards: The Smarter Choice for Your Financial Needs!

Jan 6, 2025

Table of Contents

Key Takeaways

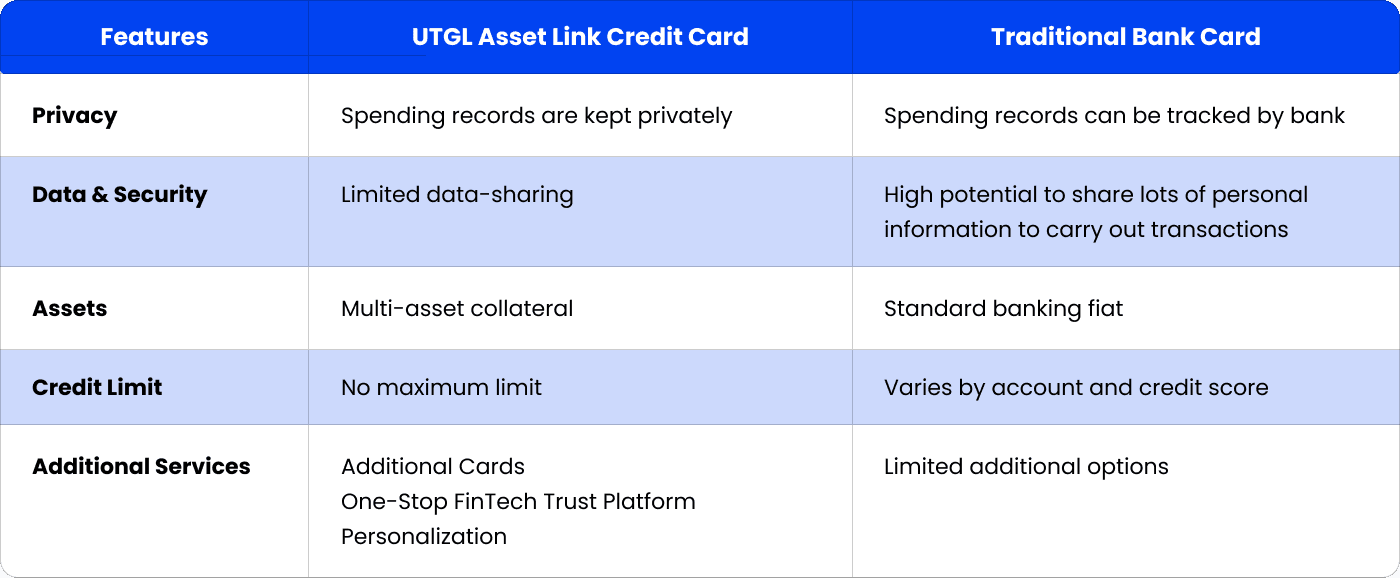

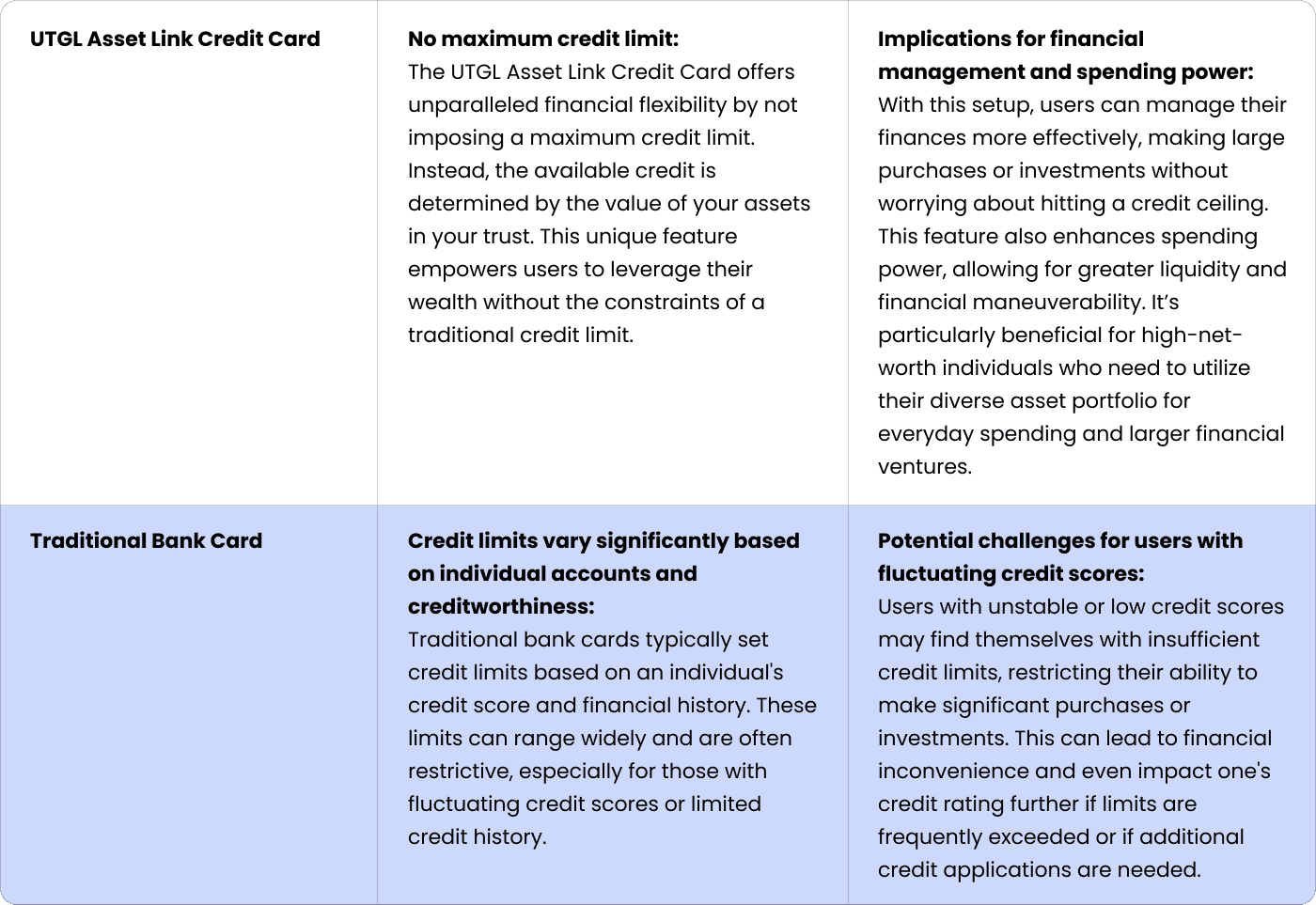

In today's fast-paced financial world, traditional banking methods face new challenges from innovative financial tools that promise greater security and convenience. One standout option in this evolving landscape is the UTGL Asset Link Credit Card. This cutting-edge solution is uniquely designed to connect directly to your trust account, revolutionizing the way you manage your finances. This article delves into the unique features of the UTGL Asset Link Credit Card, comparing it with traditional bank cards in key areas that matter most to you.

Privacy

UTGL Asset Link Credit Card: Your Shield for Financial Privacy

Enhanced Privacy with UTGL: The UTGL Asset Link Credit Card provides a distinct benefit by processing transactions under 'UTGL' instead of your personal name, ensuring payment receipts display 'UTGL' to maintain your financial privacy. With frequent identity theft, particularly credit card fraud, becoming increasingly prevalent, this card helps protect against fraudsters who exploit stolen personal information to open accounts. Using the UTGL Asset Link Credit Card, makes it harder for criminals to link your identity to any transactions.

Minimized Data Sharing for Maximum Security: UTGL emphasizes high privacy consumption, ensuring that financial activities are not shared with third parties. Your financial activities remain confidential, minimizing the risk of your information being sold or misused, thus safeguarding your financial security.

Traditional Bank Card: Navigating Privacy Risks

Real Name Exposure Increases Risk: Traditional bank cards are usually issued under your real name, leading to greater data exposure and potential privacy risks. This is because real name usage can make it easier for malicious entities to target individuals for identity theft and fraud.

Widespread Data Sharing Practices: Traditional bank cards often share personal information with credit bureaus and third parties, which can compromise privacy and increase the risk of fraud. For example, Barclays planned to sell the spending habits of 13 million customers, and ING has faced criticism for selling customer data for marketing purposes. Although banks are discussing ways to tighten and revamp their practices to better balance data sharing with customer privacy, such sharing still occurs, unlike with UTGL.

Asset Management

UTGL Asset Link Credit Card: Unlocking Multi-Asset Potential

Harnessing Diverse Collateral: The UTGL Asset Link Credit Card distinguishes itself by allowing users to leverage a variety of assets, including digital assets, precious metals, and real estate, as collateral. This flexibility in asset management enables users to diversify their portfolios and manage their wealth more effectively.

Empowering Financial Flexibility Through Asset Leverage: By permitting the use of various assets as collateral, the UTGL card offers greater financial flexibility. This means you can access credit without liquidating your investments, helping you preserve long-term wealth while addressing short-term financial needs. This integration promotes smarter asset management and enhances your overall financial strategy.

Traditional Bank Card: Navigating Limitations

Tied to Standard Fiat Currencies: Traditional bank cards are typically linked to standard fiat currencies, such as USD, EUR, or HKD. This limitation can confine users to conventional banking systems and currencies, potentially reducing flexibility in managing diverse assets.

Limited Asset Integration Options: Bank cards usually do not provide the same level of integration with multiple asset types as the UTGL Asset Link Credit Card. Users often cannot use alternative assets, like digital assets or precious metals, as collateral, which limits their ability to diversify and effectively manage their financial resources.

More Than Better: The UTGL Asset Link Credit Card Offers Extra Services for Modern Needs

Beyond these core advantages of its privacy and flexibility, the UTGL Asset Link Credit Card introduces additional services that align perfectly with the demands of contemporary customers who prioritize security and convenience.

Additional Cards

The option to obtain additional cards for family members or business purposes enhances accessibility and streamlines financial management within households and organizations. With just one trust account, your family members, friends or employees can enjoy the suite of exclusive benefits and privileges.

One-Stop FinTech Trust Platform

The dedicated asset management portal offered by UTGL serves as a comprehensive solution for monitoring and managing your assets. This streamlined platform features real-time tracking, allowing you to monitor your financial activities closely. Moreover, setting up UTGL AutoPay for your credit card bills, you can simplify your financial management and avoid missing due dates. With all these functions available in one place, you can focus your financial activities on a single platform.

Personalization

The UTGL Asset Link Credit Card allows for personalization, enabling cardholders to customize their cards with a chosen name or a distinctive design. This feature not only adds a sense of prestige but also allows individuals to showcase their personal style. More than just a financial instrument, UTGL Asset Link Credit Card becomes a reflection of your individuality. Carry a credit card that is uniquely yours while enjoying the many benefits of being a UTGL cardholder.

Revolutionize Your Financial Journey with the UTGL Asset Link Credit Card

The UTGL Asset Link Credit Card offers reliable security, user-friendly features, and innovative services, making it an excellent alternative to traditional banking. Its unique offerings cater to modern financial needs, positioning it as a strong choice for those looking to enhance their financial management.

Choosing the right card can significantly shape your financial journey. We encourage you to consider what best suits your lifestyle and goals. Alternatively, we invite you to schedule a complimentary consultation with our expert team. We will assess your specific needs and provide a tailored evaluation, ensuring we develop a customized solution that aligns with your financial objectives.

RELATED ARTICLES