Trust

Is Your Money Safe? The Truth About Banks and the Safe Alternative

Nov 15, 2023

Table of Contents

Key Takeaways

#bankcrisis #trustvsbank

Traditional wisdom also tells us to put our money in banks. Banks are considered the safest, but who would have thought that today's safest place could be the most dangerous?

The belief that banks are the safest might be a lie. If 99 people say something is true, then the 100th person will definitely believe it. But after the incidents at Lehman Brothers and the near-insolvency of AIG, along with Barclays in 2008 and Silicon Valley Bank in 2023, even a Swiss investment bank as venerable as Credit Suisse, with its 167-year history, publicly acknowledged 'significant deficiencies' in March, causing stock market crashes and client runs. It doesn't matter whether there is bank regulation or not, crises can still occur.

From all these news, we can say that we have entered the era of Black Swan Era globally. A Black Swan represents unpredictable risks, things you think will never happen, but they do occur. In the future, there will be more and more such cases, and we cannot use traditional wisdom experience to evaluate them.

Why might banks be seen as unsafe?

Primarily, it's crucial to recognize that the majority of banks operate under a system known as fractional banking. This means banks are only required to keep a small portion of their customers' deposits on hand, using the remainder for interest-earning loans. For instance, if a bank has $100 in deposits, it might only need to retain 10%, or $10, and can loan out the remaining $90.

While fractional banking can promote economic development, it is inherently fraught with risks, including liquidity risk and the potential for a bank run. If all depositors simultaneously demand their money back and rush to withdraw, the bank won't have sufficient funds. This could result in widespread panic and ultimately lead to the collapse of the bank.

Additionally, banks can harness the funds deposited by customers to engage in investments like bond purchasing. However, this comes with an inherent risk. Although bonds are generally considered safe investment vehicles, they are still subject to market price fluctuations. If the market price of these bonds diminishes, the bank's balance sheet will reflect a loss which could shake the confidence of depositors. This fear of losing their money may lead them to withdraw their deposits. If such withdrawals are widespread and simultaneous, it could deplete the bank's reserves and eventually cause the institution to collapse. ,

Overall, the fractional or reserve deposit system can be likened to a ticking time bomb. There are no longer any safe havens for capital in the world. Switzerland, traditionally regarded as the safest place for funds, has experienced a financial crisis. The United States, which became a refuge for funds amid global economic downturn over the past two years, is now also facing a crisis.

So what should I do during the bank crisis?

Diversifying Your Bank Deposits

Firstly, there is wisdom in diversification. Spreading your assets among different banks can serve as a hedge against risks, this is because deposit insurance protections such as those provided by the Federal Deposit Insurance Corporation (FDIC), have coverage limits. For instance, the FDIC guarantees up to $250,000 per depositor per bank. Similarly, the Hong Kong Deposit Protection Board insures up to HK$500,000 per depositor per member institution. This essentially means that your deposits are insured and safe up to these amounts, even in case of bank failure. Any amount above these limits is not covered and hence exposed to risk. To further mitigate regional economic risk, it is advisable to distribute some funds offshore — in case a crisis originates from a single economy.

*TIP How to open offshore accounts in different jurisdictions in 5 mins?

By setting up a trust account with UTGL, you can gain access to pre-arranged bank accounts in Hong Kong and various offshore locations. This single account approach simplifies the process of diversifying your assets to mitigate regional and political risks.

>> Learn more

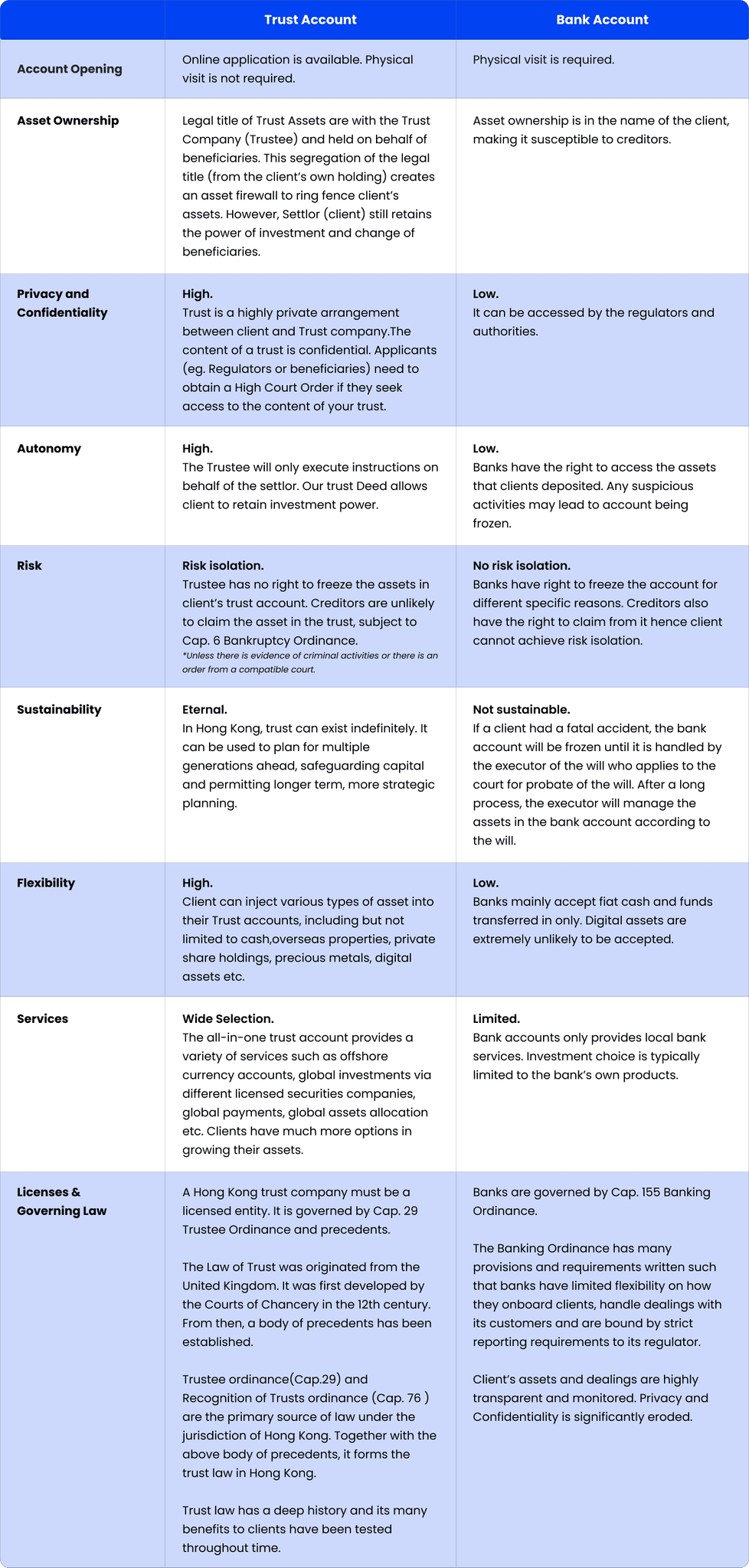

Trust Accounts: A Strategic Legal Tool for Asset Protection

Secondly, set up a trust account. When you place your assets in a trust, the trustee will only act on instructions from the settlor and does not have unrestricted access to the deposited assets — unlike banks which lend out deposits and face liquidity risks. The trustee has an obligation of prudence and holds a fiduciary duty to guard your assets imposed by the well-established case law. This essentially means that the trustee's actions are solely focused on protecting the interests of your beneficiaries.

Now, trust is not just for the wealthy, they're a valuable legal instrument for middle-class individuals too. They provide a secure way to protect assets you've worked hard to accumulate, potentially benefiting not just you but also future generations.

>> Learn more

Trust vs Bank

In conclusion, the traditional belief that banks are the ultimate safe haven for money is being challenged due to various global 'Black Swan' events and inherent risks associated with the fractional banking system. Being informed about these potential risks and having a diversified strategy in place is crucial. This includes spreading your assets across different banks and even offshore accounts to minimize risk and ensure safety beyond the limits of deposit insurance protections. Trust accounts also emerge as a valuable tool for protecting assets, providing a secure way to safeguard hard-earned wealth for current and future generations.

RELATED ARTICLES